Some Known Questions About Nj Cash Buyers.

Some Known Questions About Nj Cash Buyers.

Blog Article

Not known Details About Nj Cash Buyers

Table of ContentsThe 9-Minute Rule for Nj Cash BuyersNot known Details About Nj Cash Buyers See This Report about Nj Cash BuyersThe Nj Cash Buyers PDFs

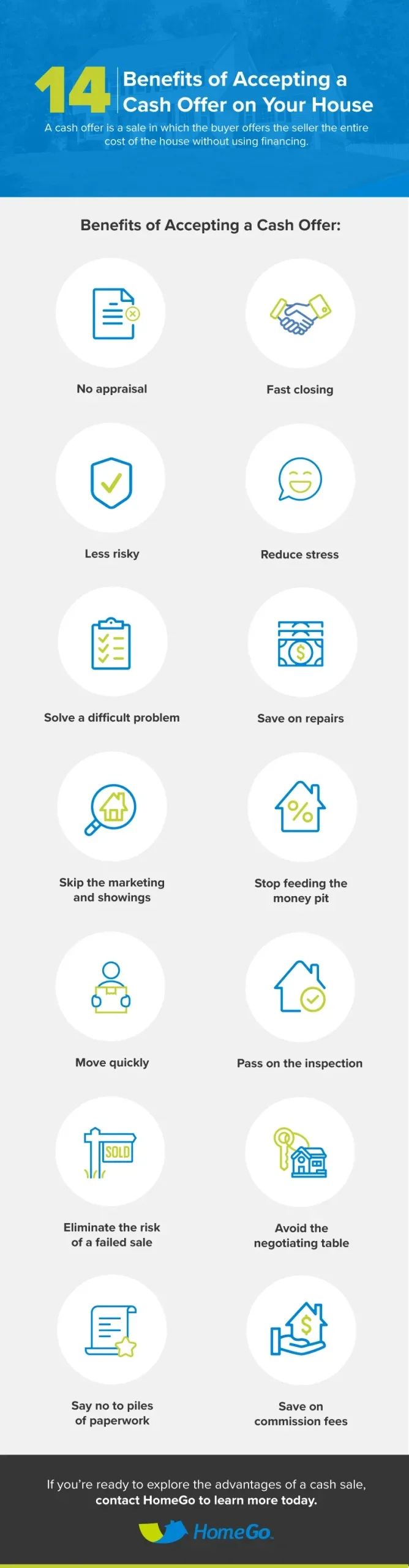

A lot of states approve consumers a particular degree of security from financial institutions concerning their home. Some states, such as Florida, completely exempt your house from the reach of specific lenders. Other states set limits varying from as little as $5,000 to as much as $550,000. "That means, no matter the worth of your home, financial institutions can not require its sale to please their cases," claims Semrad.You can still go into repossession with a tax obligation lien. If you stop working to pay your property, state, or government taxes, you might shed your home via a tax obligation lien. Purchasing a house is a lot easier with money. You don't have to wait on an inspection, assessment, or underwriting.

(https://www.fodors.com/community/profile/njcashbuyers1/about-me)I know that several sellers are a lot more most likely to accept a deal of cash money, but the seller will certainly obtain the money regardless of whether it is financed or all-cash.

What Does Nj Cash Buyers Mean?

Today, regarding 30% of US property buyers pay money for their homes. That's still in the minority. There may be some good reasons not to pay money. If you simply have adequate money to pay for a house, you may not have any left over for fixings or emergencies. If you have the money, it may be a good concept to establish it apart to ensure that you contend the very least three months of housing and living expenditures ought to something unforeseen occur was shedding a task or having clinical concerns.

You may have certifications for an outstanding home mortgage. According to a recent research study by Money publication, Generation X and millennials are considered to be populations with one of the most potential for development as consumers. Handling a little bit of debt, specifically for tax purposes great terms could be a much better alternative for your finances in general.

Perhaps buying the stock market, shared funds or an individual service may be a much better option for you in the long run. By buying a home with money, you run the risk of diminishing your reserve funds, leaving you prone to unanticipated upkeep costs. Possessing a residential or commercial property entails ongoing expenses, and without a home loan cushion, unanticipated repairs or improvements could strain your finances and hinder your capacity to keep the property's problem.

Nj Cash Buyers - The Facts

Home prices fluctuate with the economy so unless you're intending on hanging onto your home for 10 to thirty years, you could be better off spending that money somewhere else. Investing in a residential property with cash money can expedite the acquiring procedure considerably. Without the demand for a mortgage authorization and linked documents, the transaction can shut quicker, providing an one-upmanship in affordable property markets where vendors may favor money purchasers.

This can lead to substantial expense savings over the long-term, as you won't be paying rate of interest on the car loan amount. Cash customers usually have more powerful negotiation power when handling vendors. A cash deal is much more attractive to vendors considering that it decreases the threat of a bargain failing due to mortgage-related problems.

Bear in mind, there is no one-size-fits-all remedy; it's necessary to tailor your choice based on your specific circumstances and lasting goals. Ready to begin considering homes? Give me a phone call anytime.

Whether you're selling off possessions for a financial investment building or are diligently conserving to buy your dream abode, acquiring a home in all cash money can substantially boost your purchasing power. It's a calculated step that reinforces your setting as a purchaser and improves your flexibility in the genuine estate market. Nevertheless, it can put you in an economically prone place (sell my house fast nj).

Some Of Nj Cash Buyers

Minimizing rate of interest is among the most typical factors to acquire a home in money. Throughout a 30-year home loan, you can pay 10s of thousands and even hundreds of hundreds of bucks in overall rate of interest. Additionally, your getting power raises without any financing backups, you can discover a wider selection of homes.

The greatest risk of paying cash money for a residence is that it can make your funds volatile. Binding your liquid assets in a building can reduce monetary versatility and make it much more challenging to cover unforeseen costs. In addition, binding your money indicates losing out on high-earning financial investment possibilities that can produce higher returns elsewhere.

Report this page